Savings AccountMoney Market AccountMutual FundLiquidityYou can take your money from a savings account at any time. But you're restricted to six transfers or withdrawals per calendar month/ statement cycle. ATM withdrawals don't count toward this limit.You may withdraw from this account at any time.

But you're limited to six transfers or withdrawals per calendar month/ statement cycle. Not many online banks offer checking, money market accounts, savings and CDs. But Discover Bank offers all four and has competitive products in each category.

It also offers a competitive yield on its savings account. Discover Bank might be for you if you want your checking and savings at the same online bank. APYs , account minimums and whether you'd have to pay a monthly service fee are some of the most important things to look at before choosing a savings account. A savings account that charges fees likely isn't the right account for you. But many online banks offer high-yield savings accounts that don't require you maintain a minimum balance. Savings accounts that offer a competitive yield and don't require a minimum balance or charge a maintenance fee are a good fit for any type of saver.

With UMB Bank, personal banking is made easy with a suite of services from checking and savings accounts to credit services, investing and wealth management. We help you manage your money, meet your financial goals and finance your next big purchase. Our personal checking accounts and savings accounts are designed with your needs in mind, and we offer credit card and personal lending products with competitive rates. Due to expectations that the federal funds rate will remain the same, consumers are seeing marginally lower rates in a wide range of financial products, including mortgages, loans, and consumer deposit accounts. Lastly, the battle for consumer and business deposits to fortify their balance sheet remains intense as regional banks lose deposit share and online banks gain deposit share.

Below is a table of current average, low, and high savings, money market, and interest checking APYs. Enrollment with Zelle through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Available to almost anyone with a U.S.-based bank account. For your protection, Zelle should only be used for sending money to friends, family, or others you trust.

The Request feature within Zelle is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle. Neither Wells Fargo nor Zelle offers a protection program for authorized payments made with Zelle. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle through their financial institution. Small businesses are not able to enroll in the Zelle app, and cannot receive payments from consumers enrolled in the Zelle app.

For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. If you are looking for a low-risk way to save money over a long period of time, high yield savings accounts may be a good option for you. Banks that offer online savings accounts tend to have higher rates for a better return on your deposited funds, as long as you can follow any minimum balance and monthly fee rules. Keep in mind that savings rates are subject to change over time. The bank's checking account earns 1% cash back on up to $3,000 of qualifying debit card purchases each month.

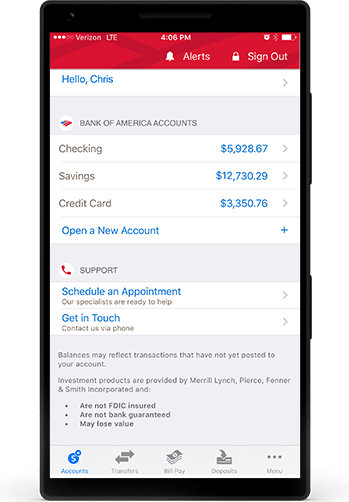

The savings account pays a competitive rate and Discover offers a suite of other products and services. Bank of America shines with a stellar online banking experience and digital tools. The website design is straightforward, and information about fees and rates is relatively easy to find. Its mobile app lets you deposit checks, pay bills, send money, monitor activity and account balances and use its virtual assistant, Erica.

Android and iOS phone users gave the bank's app high marks. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address and a social security number.

Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. 1Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number and an active unique e-mail address.

Message and data rates may apply, check with your wireless carrier. Online banks can offer higher interest rates on their deposit accounts because they have lower overheads than brick-and-mortar banks. If you are someone who likes to maintain a high checking or savings account balance, it's definitely worth exploring the great rates offered by the best online savings accounts. Making purchases or withdrawals from your savings account isn't as easy as doing it from your checking account. Unlike checking accounts, savings accounts typically won't come with a debit card for you to make point-of-sale transactions in person or online, for example.

The online bank you choose depends heavily on the products you need. Some online banks are full-service financial institutions, offering checking, savings, money market accounts, CDs and other products. Quontic Bank offers one savings account, three checking accounts, a money market account and five CDs with terms ranging from six months to five years. Quontic recently launched its Bitcoin Rewards Checking account, only available in select states so far. The mobile app gets 4.5 stars out of 5 on the App Store and 3.2 stars out of 5 on Google Play. Axos offers five different checking accounts, one savings account, one money market account and CDs with terms that range from three months to five years.

Its mobile app gets 4.7 stars out of 5 on the App Store and 4.5 stars out of 5 on Google Play. Download our mobile app to get on-the-go access to your accounts and bank securely 24/7. Anywhere you are, view your balance, deposit checks, send money, transfer funds, pay bills and more. However, money market accounts typically pay a higher interest rate than savings accounts. Money market accounts also offer check-writing and debit card capabilities, a degree of liquidity not often found with savings accounts.

Savings accounts, money market accounts and mutual funds often get lumped into the same broader "savings" category. Between the three, savings accounts and money market accounts are most alike. They are both insured by the government at banks and credit unions up to $250,000. A savings account is a type of financial account found at both banks and credit unions.

These federally insured accounts typically pay interest, but often at lower rates than other interest-bearing financial products insured by the government, like certificates of deposit . To find the best savings accounts, our editorial team analyzed annual percentage yield , minimum balance requirements, monthly fees and requirements to avoid monthly fees. All of the accounts listed below are insured by the Federal Deposit Insurance Corp. at banks or by the National Credit Union Share Insurance Fund at National Credit Union Administration credit unions. Large banks provide a wide range of products and services for people of all financial situations. As a result, there are several tiers of bank accounts with different features, benefits and fees.

For example, some higher tier checking accounts offer benefits like waived ATM fees, product discounts and the potential to earn interest, but charge higher monthly fees that have higher waiver requirements. The monthly fee and waiver requirements vary from bank to bank and state to state. Customers of online banks can initiate transactions online, through a mobile app, by phone or by mail. They also can link online bank accounts with accounts they have at traditional banks, credit unions or other online banks. To create this list, Forbes Advisor analyzed the products and services of 60 online banks, including a mix of large and small online banks and neobanks. We ranked each bank on 11 data points within the categories of product offerings, fees, APY, minimum requirements, customer experience, digital banking experience, ATM network and availability.

Bank5 Connect offers a checking account, savings account and CDs with terms from six months to 36 months. The mobile app gets 5 stars out of 5 on the App Store and 4.2 out of 5 stars on Google Play . Rates at BankFive may be higher or lower than rates at Bank5 Connect, depending on the product you choose. Quontic offers competitive APYs across its other products, along with low minimum deposit requirements and access to 90,000+ surcharge-free ATMs throughout the U.S. Quontic customers get all the features you may expect from a digital bank, including 24/7 access to online banking and a highly rated mobile app.

This bank has no monthly fees or minimum balance requirements for its checking or savings products. Customers have access to an extensive ATM network and automatic savings tools. You may even receive your paycheck up to two days early with direct deposit. ¹ Transfers require enrollment and must be made from a Bank of America consumer checking or savings account to a domestic bank account or debit card. Recipients have 14 days to register to receive money or the transfer will be canceled. Many people are missing out on guaranteed returns as their money languishes in a big bank savings account earning next to no interest.

The Ascent's picks of the best online savings accounts can earn you more than 8x the national average savings account rate. Though online banks offer higher savings rates and charge fewer fees than traditional banks, consumers should consider their individual financial needs. Having access to bank branches, for example, might be worth it depending on your personal situation. Some of the best investments — those that offer the highest returns like stocks — are more volatile and don't have the low-risk profile that a savings account at a bank or credit union offers. But you may earn a higher return on your investment for taking on more risk.

But keep in mind that investing in dividend-paying stocks or below-investment grade bonds, for example, is not as safe and stable as a savings account. Most savings accounts have variable APYs, but these yields usually don't fluctuate much. You could also incur fees if you withdraw cash from a foreign ATM (an ATM outside of your bank's network or an ATM abroad). Banks may charge a fee for sending a wire transfer or purchasing a cashier's check or official bank check. Some banks may charge you a fee if you close the savings account and withdraw your money before a certain time period.

Check with the bank to see if it charges this fee before opening your account. But if you think you'll be closing out the account within six months of opening it, try to find a savings account that requires a low-minimum balance. That way you can keep your savings account open and continue to save, no matter how low your balance is. When choosing a savings account, consider APY, minimum deposit requirements and your financial goals.

The best savings accounts will provide a competitive APY, but also give you the flexibility to securely withdraw or transfer money each statement period. Online banks offering the highest APYs and lowest fees across its products rose to the top of the list, as did those with a low minimum deposit and balance requirements and a broad ATM network. Banks with high customer satisfaction and an intuitive digital banking experience also earned higher scores. To appear on this list, the bank must be an online bank with national availability. Quontic Bank offers a cash rewards checking account that pays up to 1.50% cash back on qualifying debit card transactions each statement cycle.

The bank also offers a separate high interest checking account that pays up to 1.01% APY so long as certain monthly requirements are met. Ally Bank offers a savings account, interest-checking account, money market account and CD terms from three months to five years. It also offers a raise your rate CD with terms of two and four years and a no-penalty CD with a term of 11 months. The mobile app gets 4.7 stars out of 5 on the App Store and 4.2 stars out of 5 on Google Play. You can receive monthly direct deposits of at least $250 or maintain a minimum daily account balance of at least $1,500, among other options. There are many features and benefits when you use Bank of America's online banking services.

Business owners can manage accounts, pay bills and process payroll online. A bonus for the busy business owner is the ability to update information quickly online. Before you change your mailing address with Bank of America online, make sure you are registered for online banking. Registration takes a few minutes; the requested information includes your account numbers and specific identifying information provided to the bank when the accounts were opened.

Technology is an online bank's bread and butter, one of the things that sets it apart from the competition. For that reason, you can count on an online-only bank to have the latest in full-featured apps, encryption, and other enhancements that simplify your banking experience. Some online banks offer budgeting and savings tools to help you reach your financial goals, while others will help you keep track of your credit score. Some online banks offer fee-free withdrawals from any ATM and will even reimburse you if the host ATM charges you.

For example, say you need to take cash out of an ATM owned by a different bank or convenience store. If that bank or convenience store charges you a fee for the service, your bank will put the money back into your account. Simply put, online banks help you avoid unnecessary fees. If you have to maintain a minimum balance in order to avoid fees at your current bank, you will likely find online banks more forgiving.

Most offer no-strings checking accounts, that don't charge extra fees for low balances. Looking for high rates on savings, low rates on loans and one of the best rewards credit cards in the industry? Look no further than Altabank's personal banking services, most of which can be accessed through our user-friendly online banking system, any day, any time. Of course, if you want to get out of your jammies and visit us at one of our 26 locations, we'd love to show you what outstanding service looks like. Online banks offer savings accounts that give customers the opportunity to bank from anywhere at any time.

But these online institutions typically don't have any branches — so you can't visit them in person. Even before you look at the APY offered on a savings account, make sure you have enough money to open the account and can maintain the minimum balance requirement . Even if it's a high-yielding account, monthly maintenance fees can cause you to lose interest earnings or even some of your principal. The account products, interest rates and fees that banks offer tend to change gradually over time. We looked at consumer bank balances, deposit rate trends and fee policies at dozens of major banks to get a snapshot of the current state of banking in the U.S. With an online bank, your primary interactions take place via the bank's website and mobile app.

The best online banks provide a simple online interface and highly rated mobile apps for banking on the go. Check out reviews of the mobile app on the App Store and Google Play. In addition, purchases made using third-party payment accounts (services such as Venmo® and PayPal®, who also provide P2P payments) may not be eligible for cash back rewards. Apple, the Apple logo and Apple Pay are trademarks of Apple Inc., registered in the US and other countries. Venmo and PayPal are registered trademarks of PayPal, Inc.

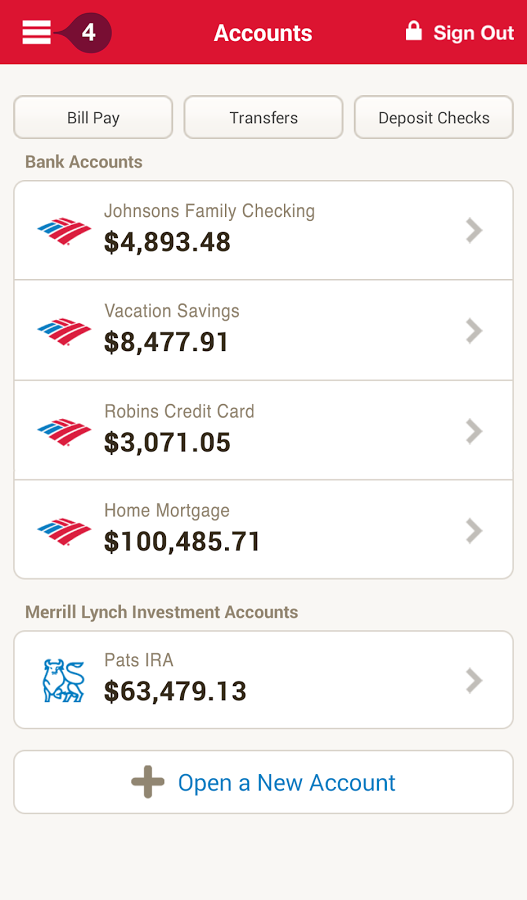

If you need your personal checking account to do more for your financial plan or to help your money work harder and fuel financial growth, UMB has a personal bank account that is right for you. Our personal savings accounts are designed with features and benefits that help you take the next step in your financial journey. In another recent addition, the bank is letting customers integrate Bank of America accounts with Merrill Lynch investing accounts in their mobile banking app, and trade from the app. Ally Bank lets customers access their investment accounts alongside their bank accounts within its app. Some fintech apps like Stash let customers work with their checking and investing accounts side by side.